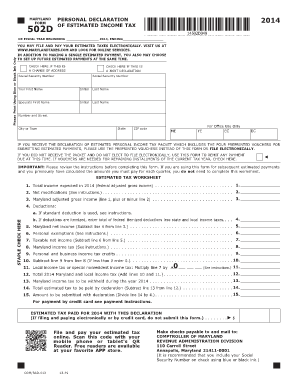

MD 502D 2018-2026 free printable template

Instructions and Help about MD 502D

How to edit MD 502D

How to fill out MD 502D

Latest updates to MD 502D

All You Need to Know About MD 502D

What is MD 502D?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about MD 502D

What should I do if I find an error on my filed MD 502D?

If you discover a mistake on your filed MD 502D, you can submit an amended form to correct the error. Ensure you complete the amendment accurately and provide a clear explanation of the changes being made. Filing an amendment is crucial to avoid complications in your tax records.

How can I verify if my MD 502D was received and is being processed?

To verify the status of your MD 502D, you can check with the relevant tax authority using their online tracking system or by contacting their office directly. Keep your submission details handy, as they may request specific information to assist you.

What types of errors commonly occur when filing the MD 502D?

Common errors while filing the MD 502D include incorrect taxpayer identification numbers, misreported amounts, and failure to include required signatures. Minimize these errors by reviewing your entries thoroughly before submission.

Are e-signatures accepted when filing the MD 502D?

E-signatures are generally accepted for the MD 502D, provided they meet the legal criteria set forth by the tax authority. Make sure to use a compliant e-signature method to ensure your submission is valid.

What steps should I take if I receive an audit notice related to my MD 502D?

In the event of receiving an audit notice regarding your MD 502D, promptly gather all related documents and review your submissions. Respond to the notice with the requested information and seek professional advice if necessary to navigate the audit process effectively.